User

Hello Trader

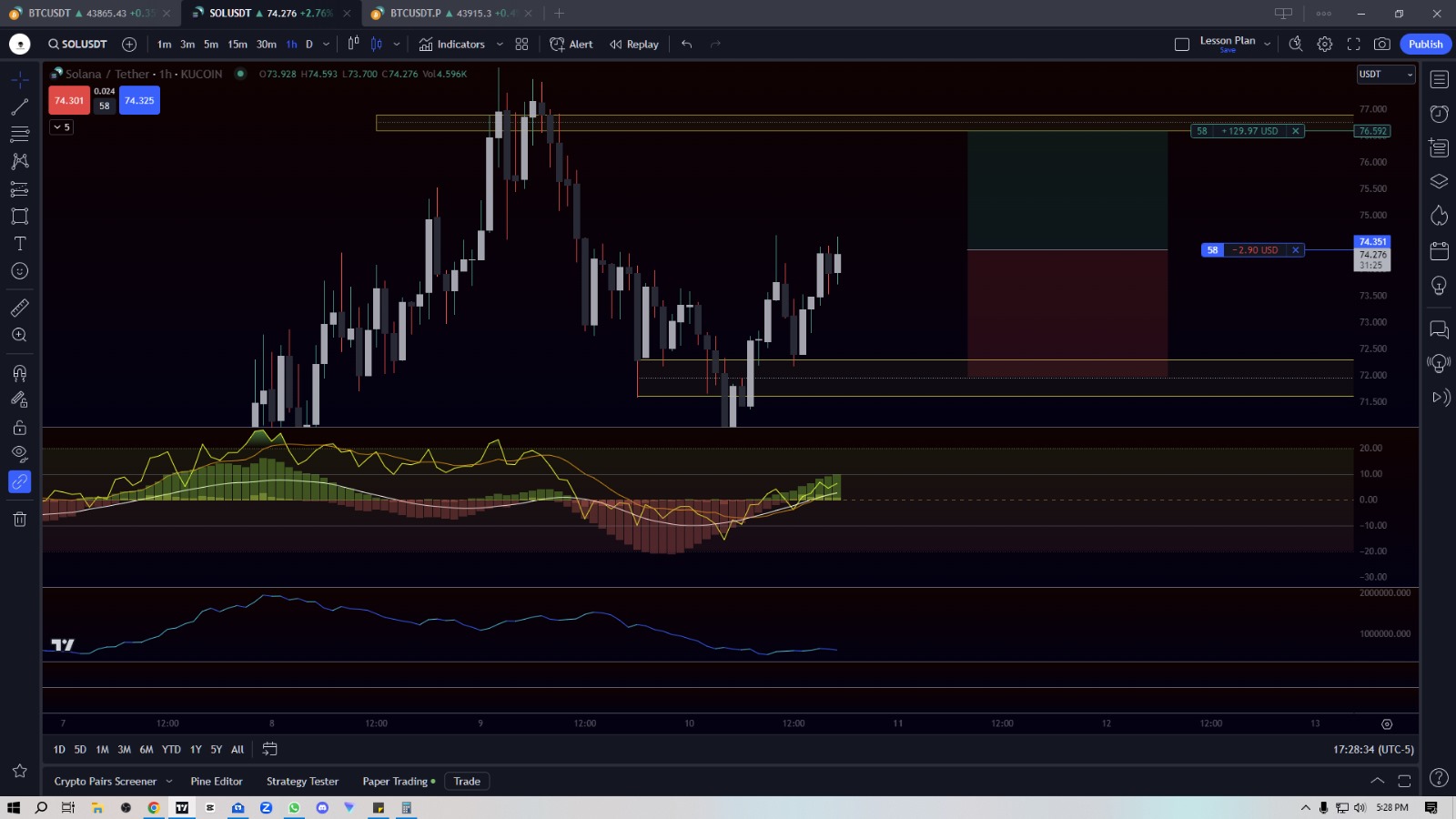

SOL USDT December 10th 2023

Available Files

No files uploaded.

Related discussions

-

Short on SOLANA (Swing Trade) December 21st 2023

its comingg. 104-106 before christmas🎅

14 Replies Posted in My Signals Trades

-

BTC February 7th 2023 SHORT

0 Replies Posted in My Signals Trades

-

ETH USDT ealy morning London sessions 2.13.2024

ok apparently that happened REALLY fast

1 reply Posted in My Signals Trades

CoffeeShopCrypto

Discussion started by CoffeeShopCrypto 2 years ago

Ill just watch it closely.

Im in on SOLUSDT at 58 contracts (shares)

Goin IN at $74.357 and expecting to reach $76.589

THis is a big move to be honest for a Sunday evening and im just going to set alerts.

The entry actually started at $72.651 so with this target i have in mind, this is a 1:6 rr

For those who done understand. That means for each dollar i put up, i expect to have 6 dollars return.

Because i entered late, this should come to a $571.00 win

but If i was at the entry candle, this would be a $3537.00 gain.

If anyone else is jumping in, feel free to upload your screenshot and tell us what you got going on

Replies

CoffeeShopCrypto

Well as you can see this trade setup actually was a failure for me because I was potentially going long on this trade but then overnight price ended...Well as you can see this trade setup actually was a failure for me because I was potentially going long on this trade but then overnight price ended up going short period #GOLD was wiped out #US30 wiped out and among some other assets taking very strong shorts including #BTC. What ended up triggering me to get out of this trade before it went against me was that I woke up in the middle of the night and decided I didn't check for divergences on the lower time frame which is where they will show up first it's kind of weird. Your trade entry will appear from your analysis on a high time frame but it is anything that's creeping up to go against your trade it's gonna appear on the lower time frame than whatever you trade was. So I actually checked the five minute chart in the three minute chart and I found three divergences all one after the other pushing price the other way and that was enough for me to say hey I don't like the way this setup is going so I got out of the trade

Show more

2 years ago

nighttalker

thanks, E. it's great to get your insight, especially your thinking in regards to checking LTF divergences. sometimes I will see price moving...thanks, E. it's great to get your insight, especially your thinking in regards to checking LTF divergences. sometimes I will see price moving against me, but it can be tricky sussing out if it's just a deeper retracement or if price is actually flipping on me. I know there's different schools of thought, like setting your tp & sl and refusing to touch the trade until one is hit. I get that approach, but my take on it is a trade is not a suicide pact, and it's okay to bail out of it when new information becomes available. thanks for sharing

Show more

2 years ago

ps.125

I've come up with a new theory.... Reducing RR's, and maximizing profits.... Use 10,28 and harsi... wait for 10,28 to cross.. Normally when they...I've come up with a new theory.... Reducing RR's, and maximizing profits.... Use 10,28 and harsi... wait for 10,28 to cross.. Normally when they cross you have a CHoCH... Now after cross use harsi to set SL and TP using RSI formula... Do not enter yet... Once RR's are set, move limit order to FVG in discount or premium zone... Use fibs to see where the levels are.. Measuring from start of move to end of move that caused the CHoCH to see premium and discount... Also set limit order slightly above or below FVG depending on what side of trade you're taking.... It works amazing... Just be sure to have the right settings on harsi to have accurate SL and TP and RSI formula calculations... NOW TEAR IT UP TRADERS!!!!!!!!!!!!!!!!

Show more

2 years ago